DAILY MORTGAGE RATE CHART

Most important point: the best use of this index is to track the CHANGE from day to day. There are so many things that can cause discrepancies between borrowers, lenders, and quotes. But because we use the same baseline scenario year after year, you can be sure that the CHANGE is a good representation of how rates are moving.

Although this chart shows the AVERAGE rates on today's market,

I can provide my clients with significantly lower rates than the average bank or lender with my wholesale pricing.

Please reach out with any questions! Ask me for a quote!

Kevin Dull - Edge Home Finance

Direct - (614) 665-8801

kevin@KDthebroker.com

Housing and Mortgage News Updates

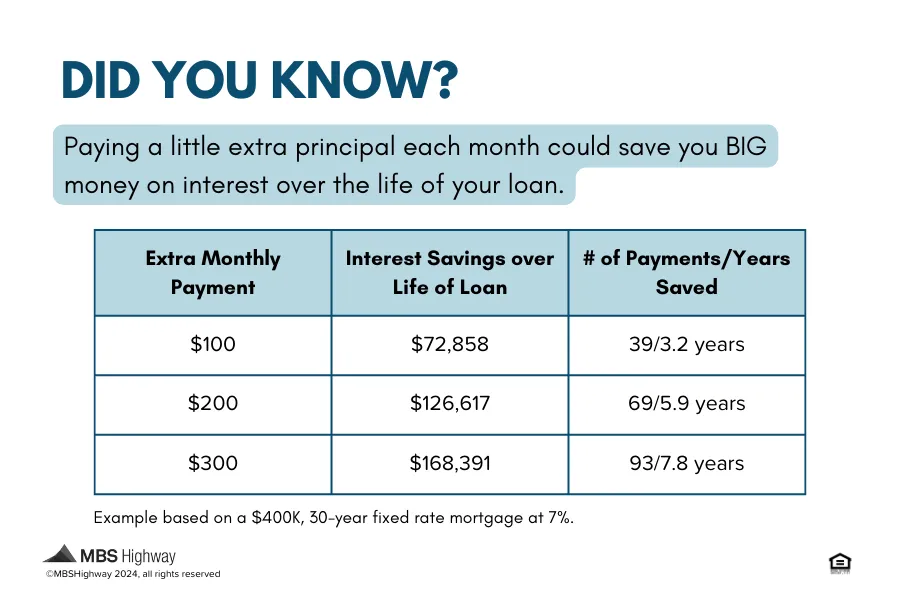

How to Save Money Over the Life of your Loan

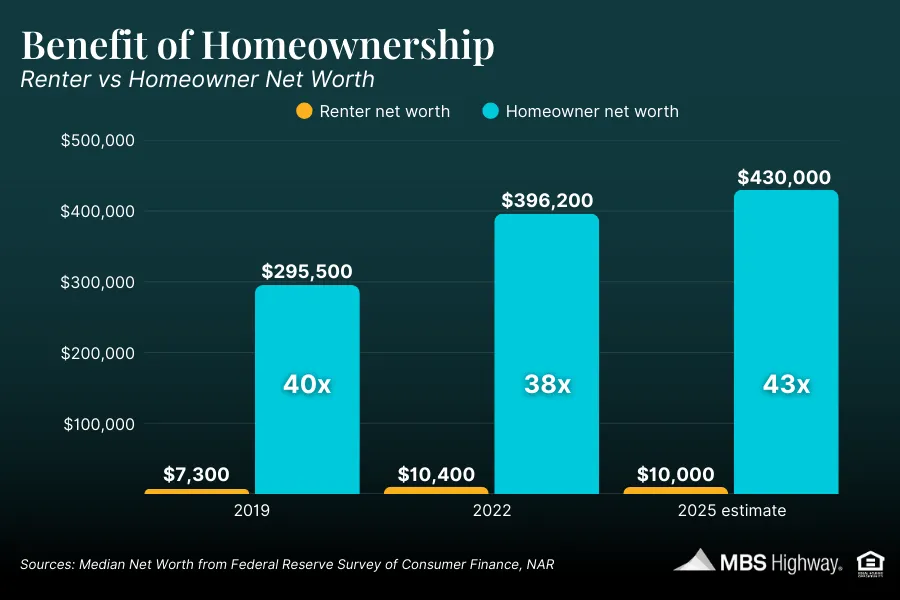

Got a little extra income monthly? Making additional payments towards your principal helps you reduce the total amount of interest paid over time and also accelerates your path to full homeownership. Questions about how this strategy works? Send me a message and let's walk through your specific situation using my handy Amortization tool.

#homeowner #wealth #amortization #mbshighway #mbssocialshare #mortgagemarketnews #mortgageintheknow